boise idaho sales tax rate 2019

The 2018 United States Supreme Court decision in South. The County sales tax.

Online Sales Tax Laws In Idaho Forix

The current state sales tax rate in Idaho ID is 6.

. Some but not all choose to limit the local sales tax to lodging alcohol. An alternative sales tax rate of 6 applies in the tax region. The minimum combined 2022 sales tax rate for Boise Idaho is 6.

The Idaho sales tax rate is currently 6. Rates include state county and city taxes. Idaho has state sales tax of 6 and.

The Idaho ID state sales tax rate is currently 6 ranking 16th-highest in the US. An alternative sales tax rate of 6 applies in the tax region Ada which appertains to zip codes 83702 83709 83712 and 83713. The 95 sales tax rate in Boise City consists of 45 Oklahoma state sales tax 2 Cimarron County sales tax and 3 Boise City tax.

2022 List of Idaho Local Sales Tax Rates. Counties and cities can charge an. The latest sales tax rates for cities in Idaho ID state.

2020 rates included for use while preparing your income tax deduction. Last full review of page January 27 2016. Non-property taxes are permitted at the local.

The Idaho state sales tax rate is currently. Sales Tax Idaho Code section Title 63 Chapter 36 Sales and Use Tax Rules. The total tax rate might be as high as 9 depending on local municipalities.

An alternative sales tax rate of 6 applies in the tax region Ada which appertains to zip codes 83702 83709 83712 and 83713. The latest sales tax rate for Boise ID. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

Idaho 2019 Tax Rates. Your free and reliable 2019 Idaho payroll and historical tax resource. 15 lower than the maximum sales tax in OK.

Boise is located within Ada County. Average Sales Tax With Local. 2020 rates included for use while preparing your income tax deduction.

Lowest sales tax 6 Highest sales tax 9 Idaho Sales Tax. The median property tax in Boise County Idaho is 1044 per year for a home worth the median value of 186700. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

Depending on local municipalities the total tax rate can be as high as 9. An alternative sales tax rate of 6 applies in the tax region. The average local rate is 003.

This is the total of state and county sales tax rates. Sales Use. This rate includes any state county city and local sales taxes.

Form 1250 INSTRUCTIONS Greater Boise Auditorium District Tax Return 12-06-2021. Last full review of page January 27 2016. The minimum combined 2022 sales tax rate for Boise Idaho is.

The Boise County sales tax rate is. Prescription Drugs are exempt from the Idaho sales tax. The current state sales tax rate in Idaho ID is 6.

Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax. Boise County collects on average 056 of a propertys assessed fair. Payroll Resources Small Business Insights Try Payroll Trial.

In May 2021 Idaho Governor Brad Little signed into law HB. 380 which effective retroactive to January 1 2021 lowers the top personal income tax rate from 6925 to 65. This is the total of state county and city sales tax rates.

Idaho S Circuit Breaker Changes Will Disproportionately Affect Low Income Seniors Idaho Capital Sun

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

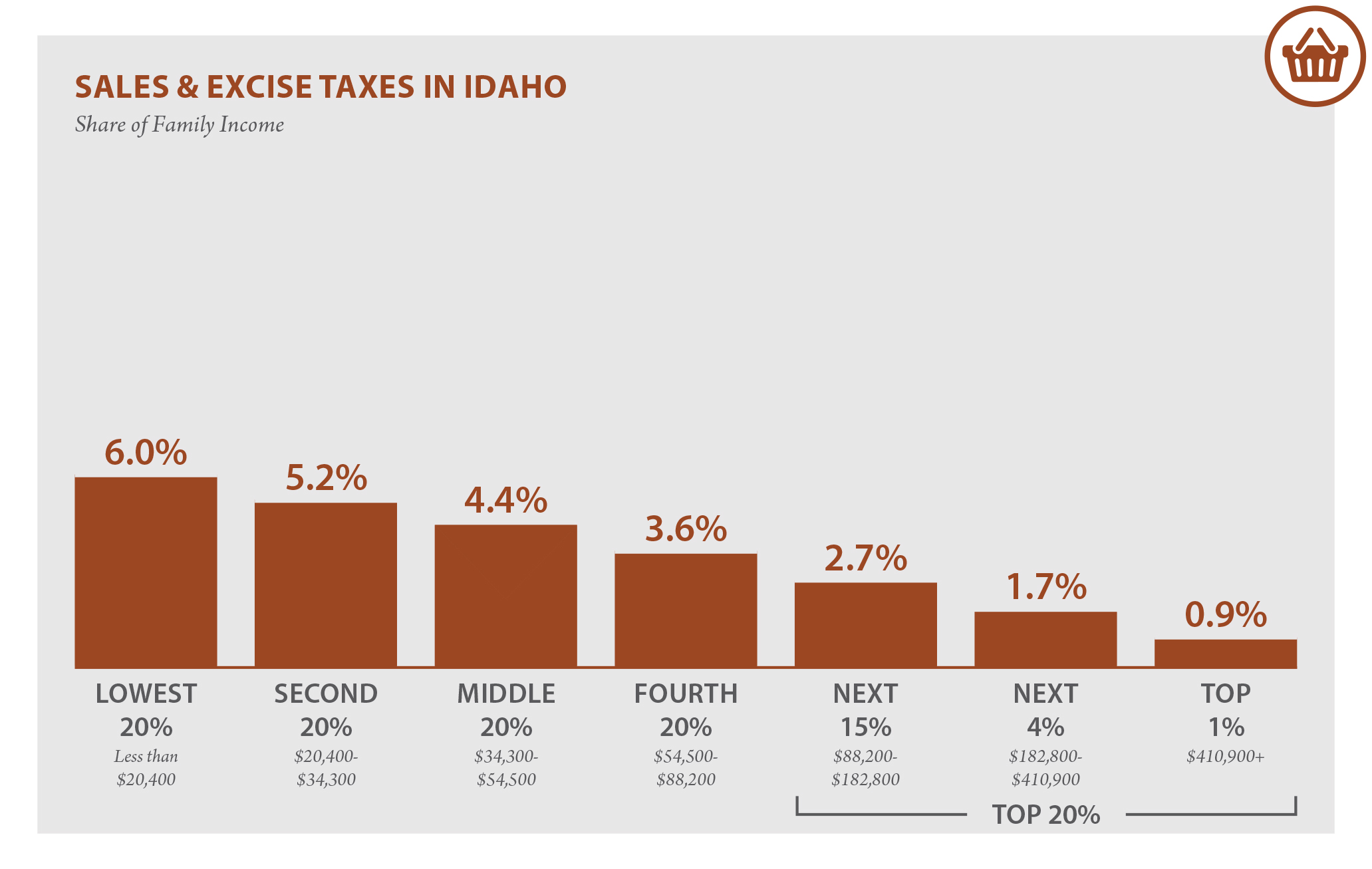

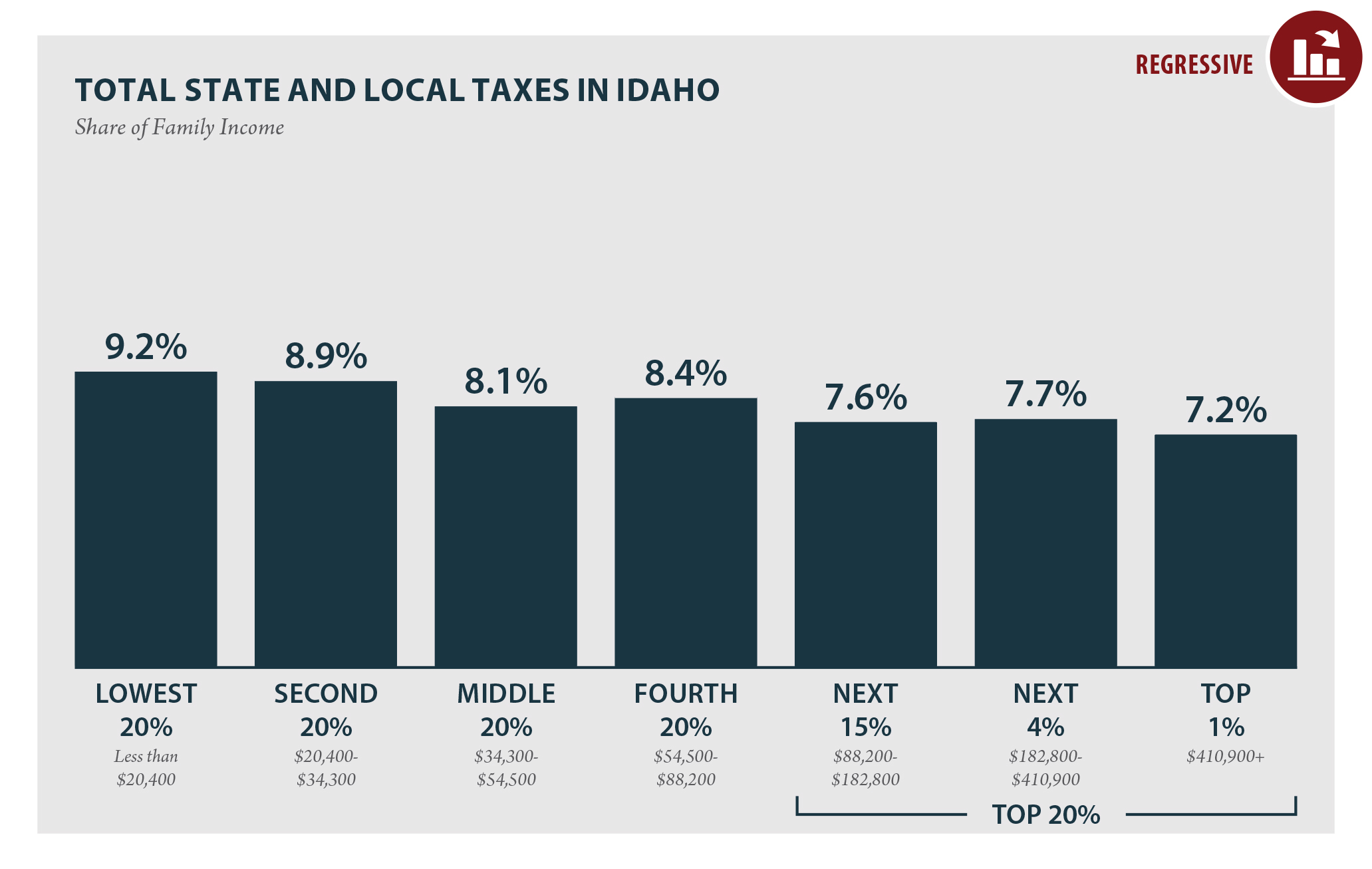

Idaho Who Pays 6th Edition Itep

Sales Tax Rates In Major Cities Tax Data Tax Foundation

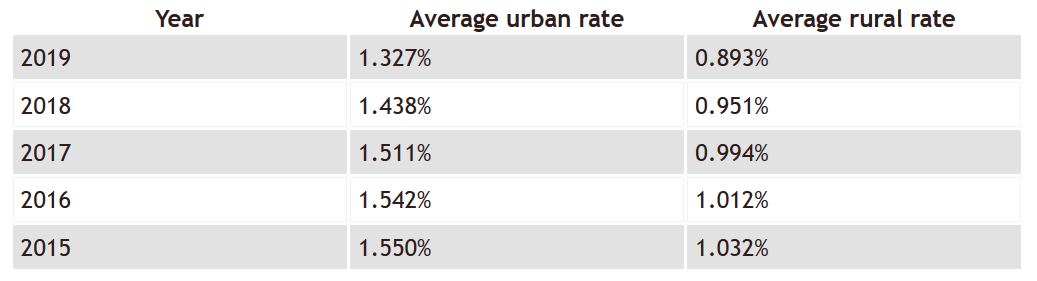

Idaho Property Taxes Everything You Need To Know

Wireless Taxes And Fees Jump Sharply In 2019 Cell Phone Tax Rankings

Overview Of The Tax Season Tax Reporting

Idaho Income Tax Calculator Smartasset

Idaho Sales Tax Rates By City County 2022

State Corporate Income Tax Rates And Brackets Tax Foundation

Idaho Property Tax The Complete Guide To Rates Assessments And Exemptions

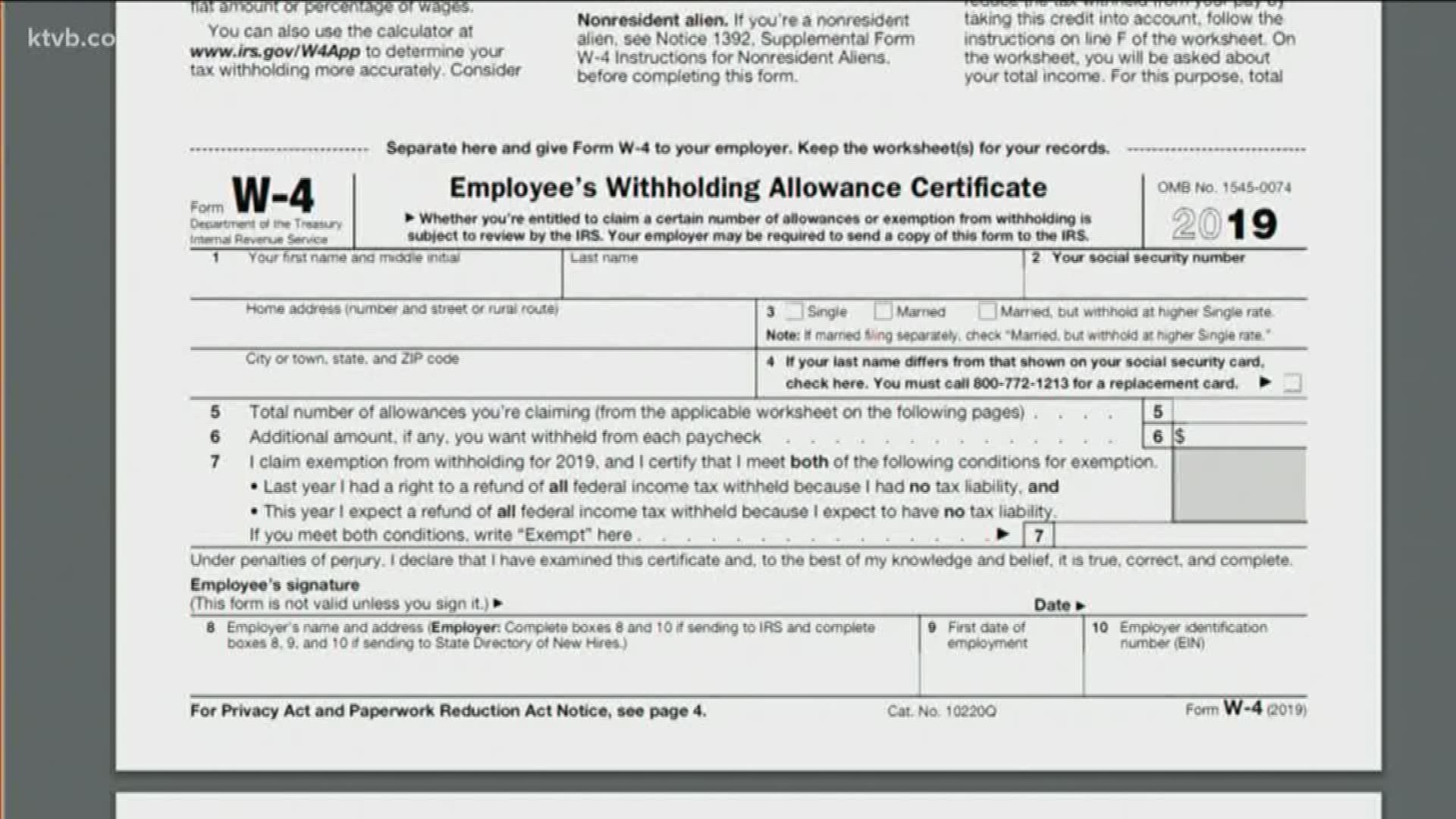

New Tax Laws Will Change How Income Taxes Are Withheld From Your Paycheck Ktvb Com

Idaho House Approves Massive Income Tax Cut And Rebate Plan Ap News